The tech world is reeling from today’s breaking news: Meta has officially acquired Manus AI (and its parent company, Butterfly Effect) for an estimated $2-3 billion.

Most analysts are focusing on the technology. But at Appark, we follow the money.

We dug into the mobile performance data of Manus AI and its sibling product, Monica AI, to answer the real question: Is this acquisition just hype, or is there a proven business model?

The data tells a shocking story. While Monica AI is famous, the younger sibling—Manus—is the one printing money, despite facing a massive user backlash over its pricing.

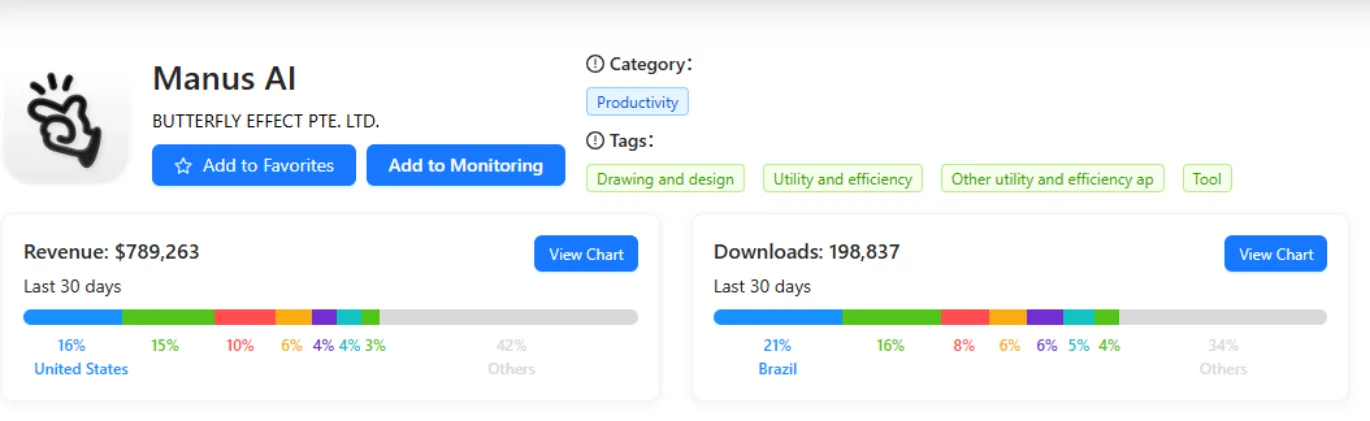

The $789,000 Surprise: Manus AI Revenue Stats

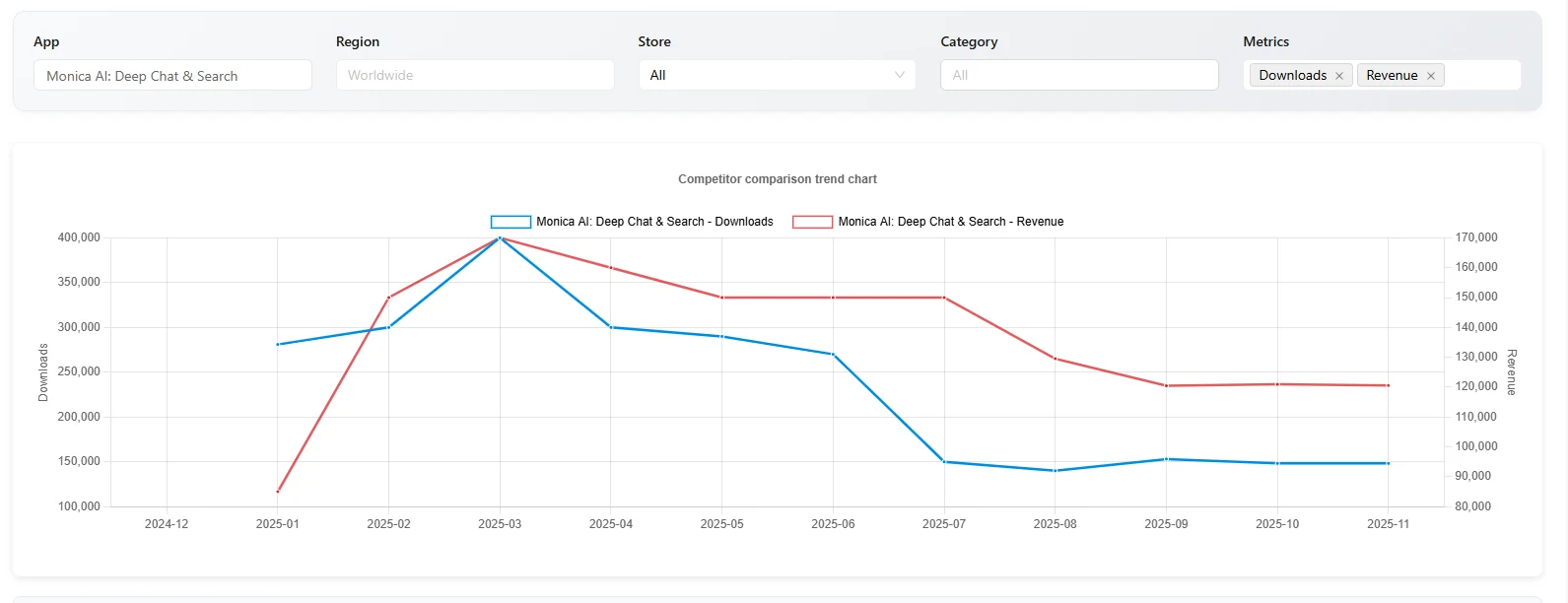

For months, the industry believed Monica AI was the "cash cow" while Manus was the "experimental project." Appark’s data proves this wrong.

According to our latest December 2025 data scan:

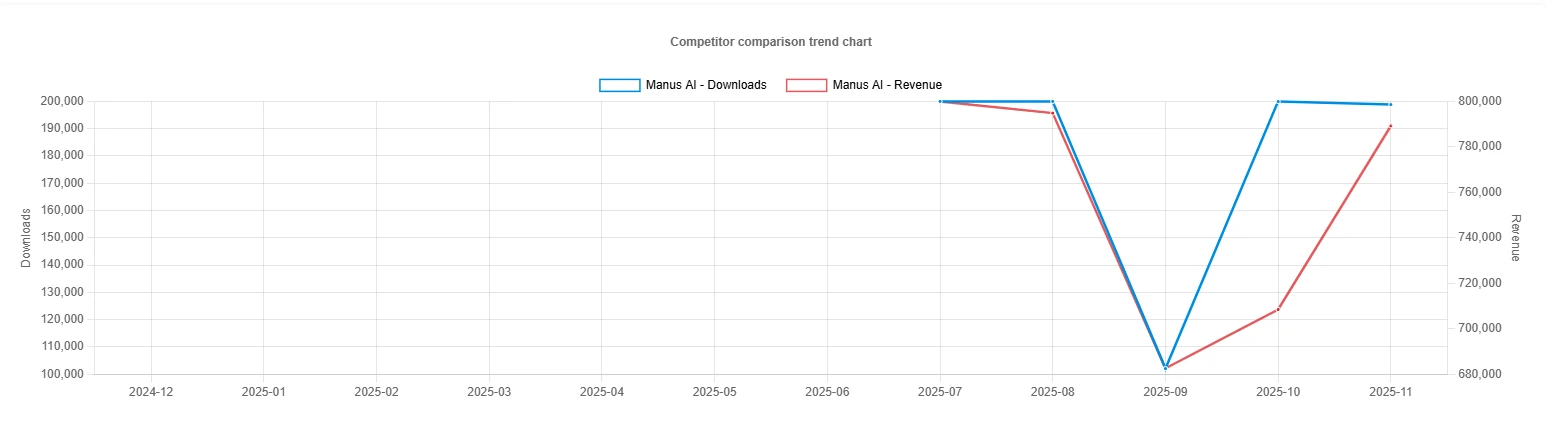

Manus is generating nearly 6.5x more revenue on mobile than Monica. Even more impressive is the trend line (shown above). After a dip in September, Manus revenue rebounded sharply to hit nearly $800k in November, suggesting strong retention among high-paying enterprise users.

The "Global Gap"

The user base distribution is equally fascinating:

- Downloads: Driven by Brazil (21%), indicating mass appeal in emerging markets.

- Revenue: Driven by the United States (16%), proving that while the world wants to try it, US professionals are the ones paying for it.

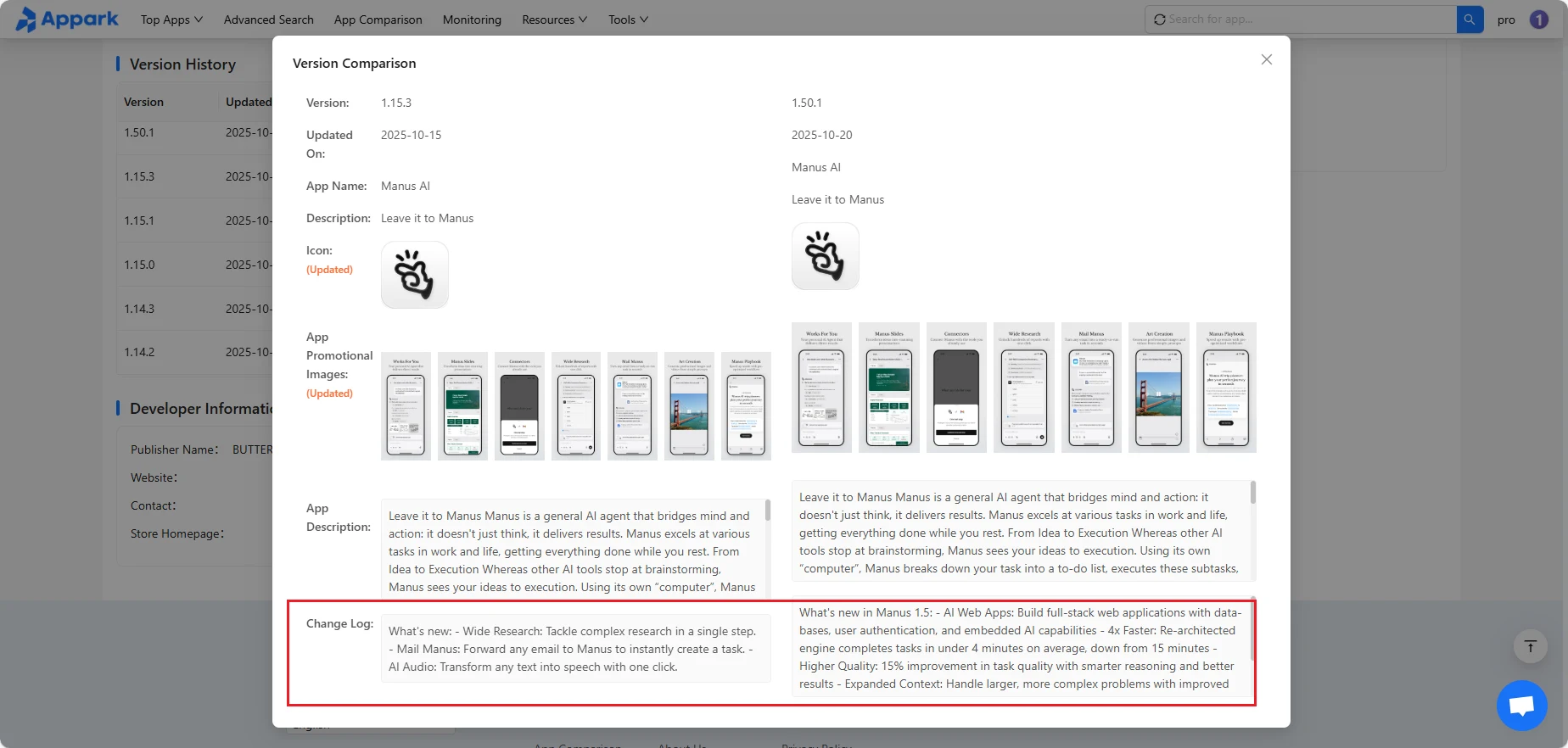

Decoding the Spike: The "Version 1.5" Pivot

Why did revenue skyrocket in November? Appark’s Change Log History provides the answer.

On October 20, 2025, Manus released Version 1.5, a massive update that fundamentally changed the product's value proposition:

Change Log Highlights (v1.5):

- AI Web Apps: Build full-stack apps with databases & auth.

- 4x Faster: Task completion time dropped from 15 mins to 4 mins.

- Team Collaboration: Invite members to shared sessions.

The Data-Backed Conclusion:

This update shifted Manus from a "Chatbot" to a "Software Studio." The revenue spike wasn't accidental; it was driven by:

- Higher Value: Users weren't just chatting; they were building full-stack apps, justifying the high subscription cost.

- Higher Burn: The "4x Faster" engine meant users could execute more tasks per hour, burning through credits faster—leading to the monetization success (and subsequent user complaints) we see today.

Manus AI Review: Why Users Pay (And Why They Rage)

Why are people paying nearly $800k a month for an app? And why did Meta step in? The answer lies in the User Reviews, which highlight a critical conflict: Extreme Capability vs. Extreme Cost.

1. The Capability: "Options Trading" Level Intelligence

Unlike standard chatbots, Manus is an "Agent." It executes tasks.

As one user noted in a 5-star review (above), Manus is "precise and accurate... does the stuff perfectly with one ask only."

Another user specifically mentioned using Manus for "options trading" and handling portfolio tasks. This isn't just writing emails; this is high-value financial analysis. This value proposition explains why the app maintains a top 50 rank in the "Grossing" charts despite its high price.

2. The Controversy: The "Credit Burn" Crisis

However, high intelligence requires high compute power. This has led to the biggest controversy surrounding Manus AI pricing.

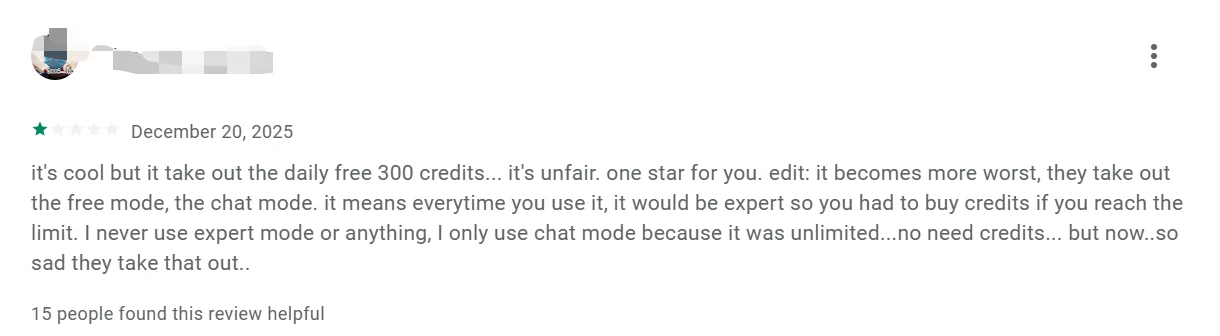

Recent reviews from December 2025 reveal a major pain point:

- "Unacceptable Credit Burn": One user reported burning ~1,000 credits per day for basic tasks.

- Removal of Free Tiers: A 1-star review slammed the removal of the "daily free 300 credits," forcing users into paid "Expert Mode."

This is exactly why Meta bought them.

Manus, as an independent startup, likely couldn't afford the massive GPU costs required to run these complex agents for free. They had to pass the cost to the user, leading to "Credit Burn" and churn.

Meta, with its infinite compute resources (Llama infrastructure), can solve this instantly. They can subsidize the cost, making Manus's "Expert Mode" affordable—or even free—for billions of users.

Manus vs Monica: The Future of the Ecosystem

With this acquisition, Meta now owns two distinct assets verified by Appark data:

| Metric | Monica AI | Manus AI |

|---|---|---|

| Role | The Mass Market Assistant | The High-End Specialist |

| Revenue (Mobile) | ~$120k / month | ~$789k / month |

| Key Market | General Productivity | Complex Execution (Coding/Finance) |

| Meta's Plan | Integrate into WhatsApp/Messenger | Power the core "Agent" infrastructure |

Conclusion: Data Doesn't Lie

The $3 billion price tag wasn't a gamble. Meta bought Manus because it had already proven something difficult: Mobile users are willing to pay premium prices for Autonomous Agents.

The revenue data shows the demand is there. The review data shows the pricing model was broken. Meta simply bought the revenue stream and fixed the pricing model.

Want to spot the next breakout AI app before it gets acquired?

Use Appark to track revenue spikes, download trends, and user sentiment in real-time.

FAQ

Q1: How much does Manus AI cost?

A: Before the acquisition, Manus AI operated on a credit system with a Pro plan around $199/mo for heavy users. User reviews indicate high credit consumption for complex tasks.

Q2: Why is Manus AI revenue higher than Monica AI?

A: Although Monica has more users, Manus targets high-value professional use cases (like coding and trading). Appark data shows Manus earning ~$789k/mo compared to Monica's ~$120k/mo on mobile.

Q3: Is Manus AI better than Monica?

A: They serve different needs. Monica is better for quick chat and search (Copilot). Manus is better for executing multi-step autonomous tasks (Agent).

Q4: Did Manus remove its free plan?

A: Yes, recent user reviews from December 2025 confirm that Manus removed its daily free credits and chat mode to manage high server costs, sparking some negative feedback.