The mobile gaming market in early 2026 has delivered a clear message: merge games are no longer just a "sub-genre"—they are now a primary engine for global revenue growth. While the industry previously looked to hardcore RPGs and SLGs for top-tier earnings, a significant shift in the leaderboard has placed casual titles at the forefront of the digital economy.

The standout performer of this era is Microfun. By December 2025, their portfolio reached a staggering monthly revenue milestone, with their leading titles collectively surpassing $150 million. This performance officially places them in the same league as global legends like King and Playrix.

1. Market Data Breakdown: The Billion-Dollar Merge Category

The financial scale of the merge games sector has reached unprecedented heights. Microfun’s success is anchored by two flagship titles that have consistently climbed the global charts:

- Gossip Harbor: In December 2025, this title alone generated over $115 million in IAP (In-App Purchase) revenue across iOS and Google Play.

- Seaside Escape: As the strong second pillar, it contributed nearly $28 million monthly, showing a steady upward trajectory in download-to-revenue conversion.

When these figures are combined with the increasing volume of non-IAP revenue streams typical of the casual sector, the total economic impact of these two games far exceeds traditional "heavyweight" titles.

2. Global Ranking Shift: Casual vs. Hardcore

The most telling sign of the merge games boom is found in the publisher rankings. According to Sensor Tower’s December 2025 report, the landscape for Chinese mobile game exports (Chuhai) has been completely reshaped.

For the first time, Microfun has secured a spot in the Top 3 Chinese Publishers by global revenue, trailing only behind Tencent and Century Games (DotPigeon). This is a historic shift, as traditional giants specializing in mid-core and hardcore content—such as NetEase and MiHoYo—have seen their mobile-only rankings surpassed by a casual-focused publisher.

Current Top 15 Analysis

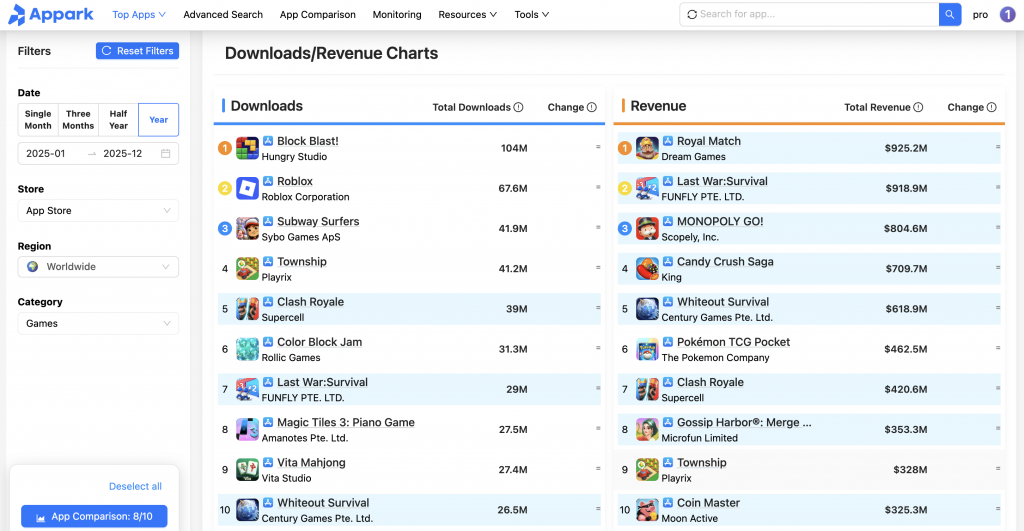

Within the Top 10 revenue chart (data from Appark), merge games now occupy seven critical positions:

- Royal Match (Dream Games) - Ranked 1st

- Last War: Survival (FUNFLY PTE.LTD) - Ranked 2nd

- Candy Crush Saga (King) - Ranked 4th

- Whiteout Survival (Century Games Pte. Ltd.) - Ranked 5th

- Clash Royale (Supercell) - Ranked 7th

- Gossip Harbor (Microfun) - Ranked 8th

- Coin Master (Moon Active) - Ranked 10th

3. Competitive Landscape: The Battle for the Merge-2 Crown

While the merge games category was once pioneered by Western studios, Chinese developers have utilized superior data-driven iteration to seize market share.

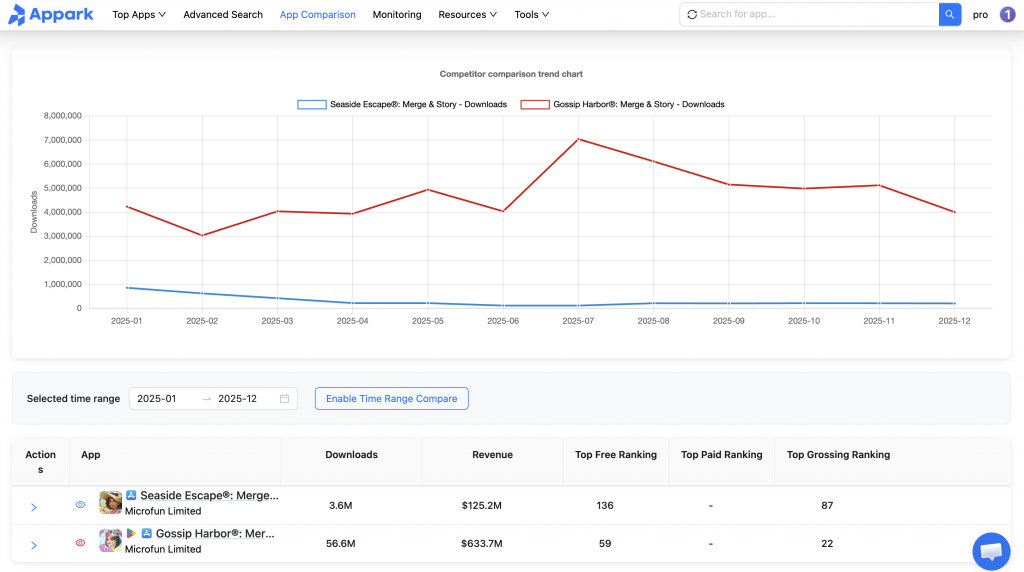

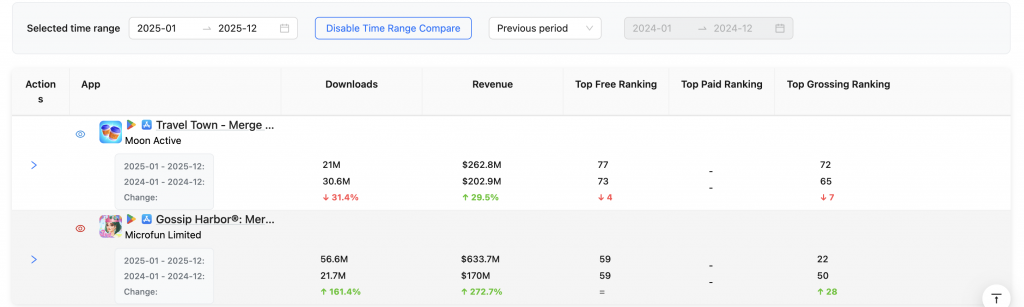

Microfun vs. Magmatic Games (Travel Town)

The rivalry between Gossip Harbor and Travel Town provides a fascinating case study in market endurance. Two years ago, Travel Town was the undisputed leader with roughly $30 million in monthly revenue. By early 2026, while Travel Town has grown to $45 million, Gossip Harbor has tripled that figure, effectively capturing the lion's share of new users entering the genre.

The Emerging Challenger: Century Games

The competitive field is intensifying with the entry of Century Games. Their title, Tasty Travels, has seen a monthly revenue explosion to $20 million. As a publisher with deep pockets and a history of dominating the SLG sector, their pivot toward merge games suggests that the category's growth potential is far from peaked.

4. Demographic Intelligence: The "Housewife Economy"

The data confirms that the primary engine behind merge games is the "High-Value Casual Player"—specifically, females aged 35 and older. This demographic, often overlooked in the past, has proven to have higher retention rates and more stable spending habits than the younger, more volatile competitive gaming crowd.

In the global market, this group is driving the expansion of the "Silver Economy" in mobile gaming, where the simplicity of merge mechanics combined with high-quality visual production leads to long-term LTV (Lifetime Value).

Conclusion: The New Revenue Standard for 2026

The rise of merge games to the top of the 2026 revenue charts proves that market intelligence and category-specific focus are the keys to success. Microfun’s billion-RMB monthly revenue is not just a fluke—it is a testament to the massive, untapped potential of the global casual audience. As more publishers pivot their resources toward this sector, the competition for the next "Merge King" will only intensify.